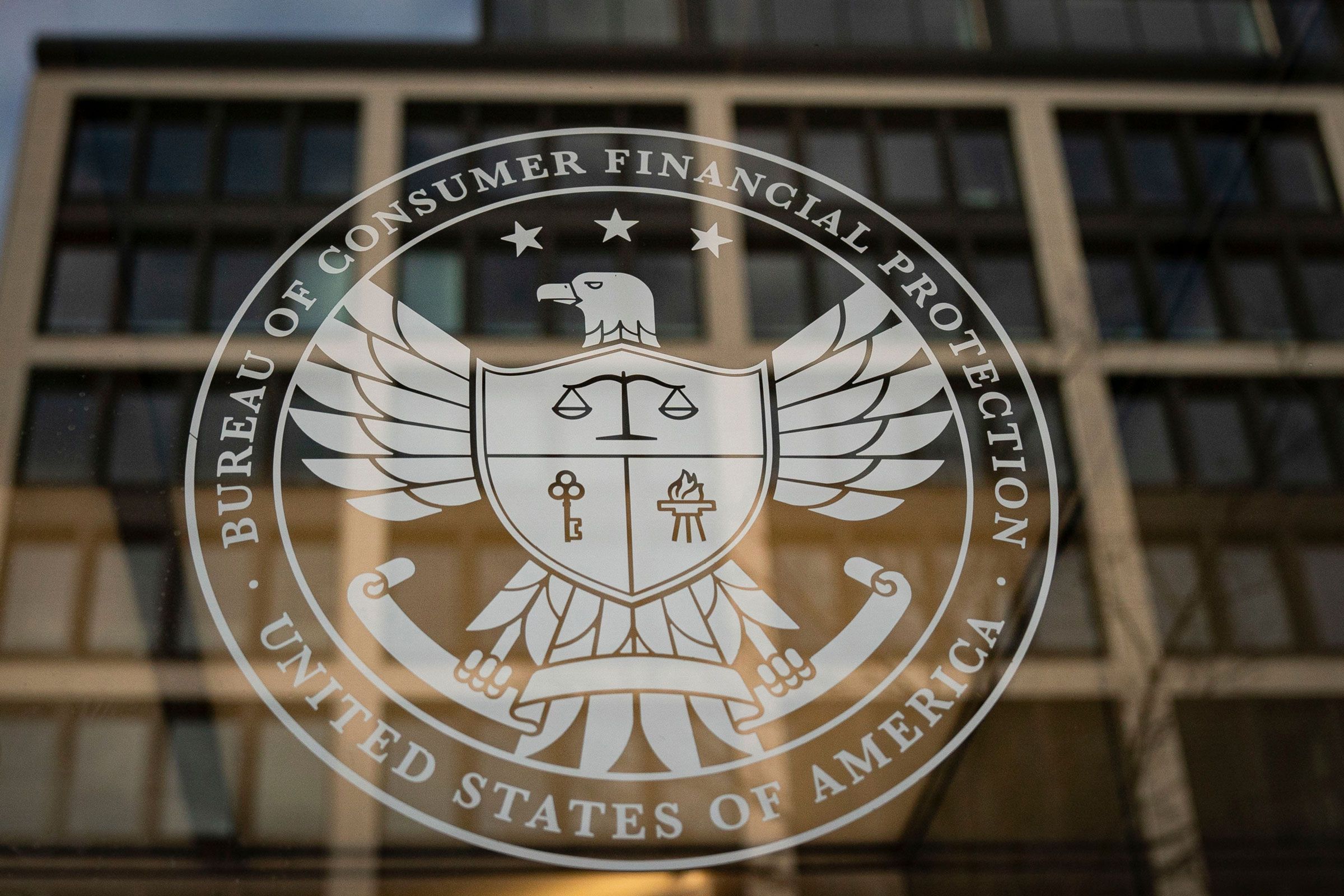

The CFPB has been dismantled.

The Consumer Financial Protection Bureau (CFPB) has been dismantled

Since its creation in 2011, the CFPB has been a powerful and independent agency dedicated…

The Consumer Financial Protection Bureau (CFPB) has been dismantled

Since its creation in 2011, the CFPB has been a powerful and independent agency dedicated to protecting consumers from financial abuses. However, recent changes in leadership and policies have led to the dismantling of the bureau.

Many experts and consumer advocates are concerned about the implications of this decision. Without the CFPB, consumers may be left vulnerable to predatory practices by financial institutions.

The CFPB was responsible for enforcing laws that regulated financial products and services, such as credit cards, mortgages, and student loans. Its dismantling could lead to weaker regulations and fewer protections for consumers.

Supporters of the dismantling argue that the CFPB was an overreaching agency that stifled innovation and imposed unnecessary regulations on businesses. They believe that dismantling the bureau will lead to a more competitive and efficient financial market.

However, opponents worry about the consequences of weakening consumer protections. They fear that without the CFPB, financial institutions will have free rein to engage in unfair and deceptive practices.

It remains to be seen what the long-term effects of dismantling the CFPB will be. Consumer advocates will continue to push for strong protections and regulations to ensure that consumers are not taken advantage of by financial institutions.

Overall, the dismantling of the CFPB highlights the ongoing debate about the balance between consumer protection and business interests in the financial industry.